Welcome to summer, Chaffey Members!

What says “summer” to you? For me, it is the Jell-O salad that my mom made when I was a kid. It had lime Jell-O, cottage cheese and pineapple, and it was always one of my favorite treats! Another favorite summer memory was digging in the family coin jar to get money for the ice cream truck…don’t worry, Mom gave her permission, but at the same time my siblings and I had not done anything to earn those coins. While that certainly gave us some hot-weather happiness, it wasn’t always the best lesson when it came to managing money. How many times have you found yourself excitedly spending money that you got unexpectedly, like a paycheck bonus or finding a $20 bill behind the couch?

Unfortunately, due to compulsive spending habits many adults still find themselves struggling to pay a $400 unexpected expense without borrowing. At Chaffey FCU, we hope to increase the number of individuals who can cover these unexpected expenses with savings instead of borrowing, but we also know that it is not always easy to change habits (like digging in the coin jar) to achieve those goals.

I am excited to share about a new program that Chaffey FCU is starting in July: we call it “Working to Ignite Success & Empowerment,” or “W.I.S.E.” W.I.S.E. is a financial counseling program that is designed to help our members illuminate their path to financial success. That success can be different for different members; perhaps your goal is to stop raiding the coin jar to build savings so you can cover those unexpected expenses, while another member’s is to develop a budget in order to purchase a home. Maybe you took advantage of a few too many “Buy Now, Pay Later” offers and you need help getting back to a comfortable position. Regardless of what your goal is, our Financial Empowerment Specialist will work with you to develop skills and explore resources to help you achieve that goal. If you or someone you know is interested in learning more about this program, please contact us!

If your coin jar is getting raided by your kids, consider downloading the My First Nest Egg app and start helping your children develop saving and budgeting habits. My seven-year-old daughter currently has a puzzle set up to help her save for a pair of sneakers, and for the first time she is folding her own laundry to earn puzzle pieces! It is a fun, interactive way for us to work together as she learns about earning, saving and spending.

Whatever the summer brings for you and your family, I hope that you are able to find some time to slow down, enjoy the warm weather, and maybe roast a marshmallow or two! As always, thank you for your membership.

PS – if you want to make my mom’s Jell-O salad, check out this recipe…it’s not exactly my mom’s, but looks just as good to me!

Diane Kotlewski

Chief Executive Officer

Working to Ignite SucceSs & Empowerment

Lighting the way for Members like you to discover financial wellness is one of our guiding principles. That’s why we are proud to announce our newest program: W.I.S.E. Financial Coaching!

W.I.S.E. is designed to help you conquer financial obstacles and receive the education and resources to lead a life of financial success. The program is personalized for each participant, and made to prioritize your needs and schedule. Take back control of your finances – start your journey today.Play

Our W.I.S.E. Financial Coaches have been certified by America’s Credit Unions (formerly the Credit Union National Association), through their Financial Counseling Certification Program. They are ready to help you understand your financial situation, and give you the resources to combat a variety of topics:

- Budgeting and spend plans

- Credit

- Debt

- Savings plans

- Retirement, and more.

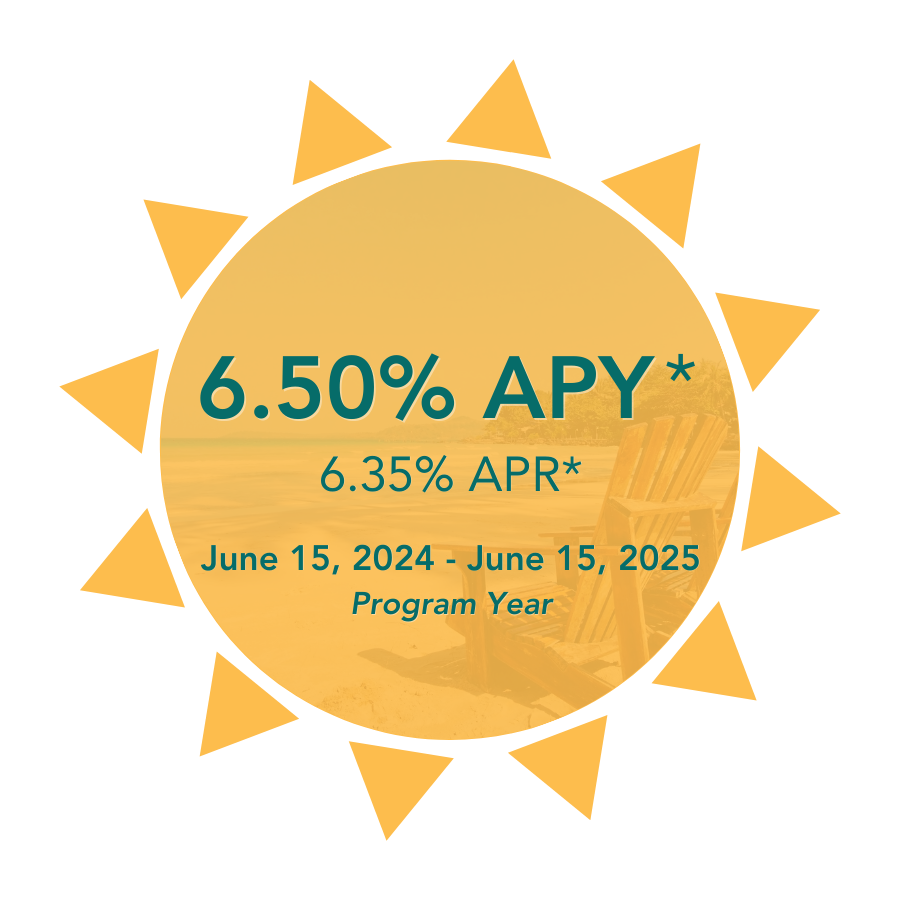

6.50% APY*

6.35% APR*. Matures June 15, 2025.

Easy-breezy savings! Make strides in your savings this summer with a high yield Summer Savings Club account – designed to help you save consistently and easily. Deposit $50 – $2,000 each month via direct deposit or payroll deduction and earn a fixed 6.50% APY* (6.35% APR)* for the entire term.

Originally created to help school staff when they expect less income over summer, the Chaffey FCU Summer Savings Club is open to all members – all at the same great rate!

Start building your sunshine!

Call our virtual team or visit any branch to open your account.

Not a member? Schedule your appointment to get started!

*APY: Annual Percentage Yield, APR: Annual Percentage Rate. Advertised rate begins at the start of the 2024-2025 program year on June 15, 2024. In the event the account is closed or funds are withdrawn before maturity, dividends that have not been credited are forfeited. APY assumes dividends remain in account until maturity; early withdrawals reduce earnings. Dividends begin to accrue once funds are deposited into account. Dividends paid at the end of each calendar quarter and at account maturity on June 15, 2025. Balance computation method is as described in our Truth in Savings Agreement. Monthly direct deposit or payroll deduction of $50 – $2,000 must be set up for account; money transfer apps (i.e.: Zelle, Venmo) do not count as direct deposit. After 60 days of no deposits, Summer Savings Club account will be closed, and funds will be transferred to your regular savings account. Account will not be closed if there are no deposits during the summer months, but will be closed if deposits do not start by October 1, 2024. Earnings transferred to chosen savings account at account maturity. Account automatically renews at maturity with the updated rate for the new program year. Limit 1 Summer Savings Club account per member. Federally insured by the NCUA.

School’s out – Learning’s in!

Summer break has officially begun!

Since the start of 2024, we brought Bite of Reality workshops to over 1,800 students! We’re proud to bring these students education on budgeting, credit, and saving before their summer breaks and graduations!

In our newest financial education platform – My First Nest Egg – local families are learning to prioritize good financial habits in amongst their kids. Nearly 200 kids are using the app through Chaffey FCU and have completed over 2,000 chores and tasks since its’ launch. Great job! Join the fun by signing up with our free code!

Build a Vacation for Your Budget

The weather is warm, school is out, and the sun is shining! We’ve gathered some tips to keep in mind to help you plan a memorable vacation that won’t break your budget.

- Choose budget friendly activities. Instead of planning your vacation solely around big activities, try taking in the local culture of your destination. Going to local events or markets can create a memorable experience that’s less expensive than alternative options.

- Build a trip spend plan. Before your vacation, be sure to know how much you’ll be spending to avoid any unwanted surprises. This includes travel and accommodations, as well as meals, shopping, or entertainment while you are there.

- Plan ahead. Spontaneous trips can be exciting – but they can also leave a lasting impact on your budget. Saving each month for your trip with an additional share savings account or automatic transfers can make the vacation bill easier to take on.

Get into the school Spirit

The next school year is quickly approaching! If you need a little help prepping for the school year, we’ve gathered some resources to help you get into the school spirit!

Start shopping early. From laptops and school organization to new clothes and shoes for growing kids – there’s a lot to get before the school year takes off. Don’t wait until days before school begins to get everything you need!

Look for discounts. Many stores cater to the back-to-school shopping rush with deals catered to students. Many big stores such as Target, Best Buy, or department stores make finding deals easy through their website. Before you begin shopping, see what discounts are offered at different stores to help you optimize savings.

Back-to-School Loan. If you need a little extra help preparing for the school year, a personal loan may be what you’re looking for. Rates as low as 9.99% APR* and no application or annual fees on back-to-school loans can help you focus on the school year, instead of high rate debt.

*APR: Annual Percentage Rate. Advertised rate quoted as of 6/25/2024, estimated payment is $32.27 per month for every $1,000 borrowed at 9.99% for 36 months. Rates are subject to change without notice. Loan subject to credit approval and income verification and is not a firm offer of credit. Other rates and terms available. First payment due 30 days after loan is approved and signed. CFCU is federally insured by the NCUA.