Happy Spring, Chaffey Members!

Thank you to all of our members who helped us celebrate our 60th anniversary in January! As we embark on our 61st year, we are excited to share a few new services that we are introducing; read through the newsletter and look for information about My First Nest Egg and File Your Taxes.com!

You may have heard talk in the news over the past several months about “junk fees.” The Federal Trade Commission defines “junk fees” as “hidden and bogus fees that can harm consumers.” One of the fees that is under scrutiny that has a potential impact on Chaffey FCU is negative overdraft charges, or what we refer to as “Courtesy Pay.” Courtesy Pay fees occur when a transaction is posted to a share draft (checking) account when funds are not available and all other sources of overdraft protection have been exhausted. Chaffey’s current fee for this service is $28 per transaction (subject to change, please refer to the current Schedule of Fees which outlines all current fees). This is a service that is only charged when a transaction is paid; you may opt in to the service and never incur a charge. Courtesy Pay disclosures are part of our Truth In Savings Agreement, which is provided to members at the time of account opening and is also available on our website. Members are required to opt in to the Courtesy Pay service for debit card transactions, and other transaction types are automatically covered subject to certain qualification criteria. A full opt-out option is available to all members. Chaffey FCU does also have guidelines in place to automatically waive the fee in certain circumstances.

Currently, there are efforts both in the State of California and at the Consumer Protection Financial Bureau (CFPB) to limit the fees or eliminate the programs altogether. If the fees generated by this program were eliminated, Chaffey FCU would no longer be able to provide this service to our members, and the cost of our other services would likely increase as a result.

Less than 10% Chaffey FCU members utilize Courtesy Pay, and of those members, the average member uses the service only seven (7) times per year. This highlights the benefit of the Courtesy Pay program, where members need transactions covered to pay bills such as rent or mortgage, or to purchase groceries when the timing of payroll deposits does not quite line up.

I bring all of this information to the membership to open an invitation to you: if you have found benefit through use of the Courtesy Pay program, please share your story with us by e-mailing chaffeymail@chaffey.com with the subject line “CP Story.” Hearing these stories directly from you will help us in our advocacy to keep this important program available to our membership.

From the team and I at Chaffey FCU, we are honored for the opportunity to serve you, and we thank you for placing your trust in us. As always, thank you for your membership.

Diane Kotlewski

Chief Executive Officer

Financial Literacy Month

Plus, a game to introduce your youngest family members to money!

Children learn from watching the actions of people around them. You have the power to introduce healthy financial habits by showing them ways to interact with and use money. Read our latest blog for a complete list of tips and resources.

- Make financial conversations a part of everyday life. Financial conversations don’t have to be intimidating. Normalize learning about finances by talking to your child about building a shopping list, paying bills, or visiting the credit union. If you don’t know where to start, the Consumer Financial Protection Bureau offers a helpful age breakdown in their Money As You Grow guide.

- Make learning about finances fun. Chaffey has partnered with My First Nest Egg to give our youngest Members a tool to build financial literacy. Financial literacy at your fingertips – introduce your child to finances with a gamified financial education platform.

- Help them set savings goals. It is essential for kids to understand that we don’t always have the funds to buy something we want right away. Help your child save money in a piggy bank, savings account, or their My First Nest Egg account to build realistic savings expectations.

A New Perspective On Financial Education

Our first financial literacy field trip!

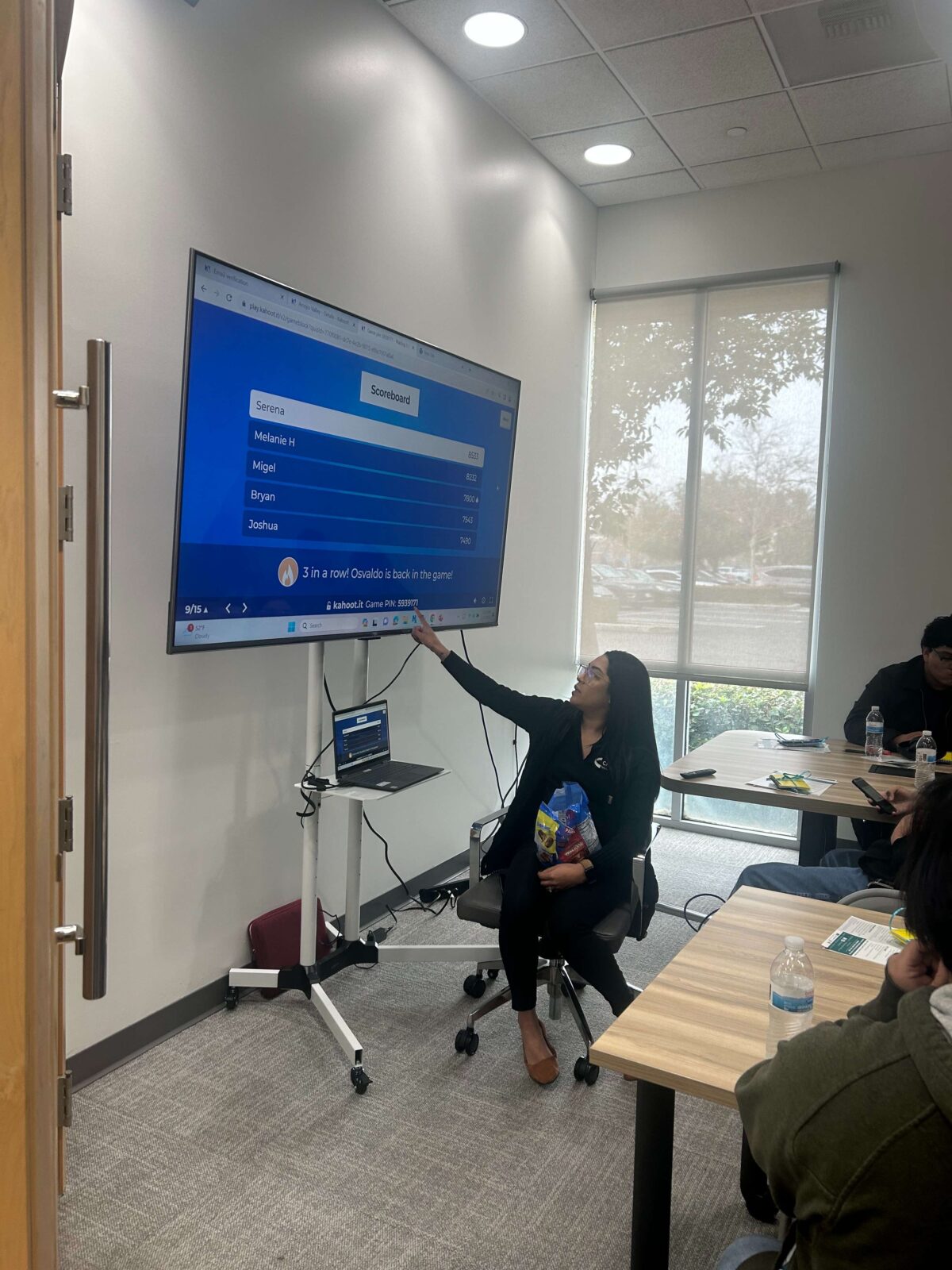

This January students from the Arroyo Valley High School Career Class joined us for a behind the scenes look at the credit union world. We were thrilled to offer not only financial education, but true insight into working in the financial industry.

In addition to our financial literacy workshop and games, the students received a special look at working in a financial institution, including a branch tour and a chance to learn directly from our Rancho Cucamonga frontline team!

A New Decade of Chaffey FCU

On January 24, 2024, Chaffey FCU reached a new milestone – our 60th Anniversary! Whether you have been a Member for years or have recently joined, we are thrilled that you are on this journey with us. As we continue forward, we are excited to celebrate future achievements with you, and to continue lighting the way for our Members to achieve financial wellness.

Hear more about recent achievements and upcoming initiatives at the Chaffey FCU 61st Annual Meeting! The Annual Meeting allows Chaffey Members to receive credit union highlights, review upcoming goals, and vote for the Board of Directors! Join us to hear from your Executive Team, and enjoy special treats and prizes!

Save your seat for In-person or Virtual attendance today!

#Random Acts of Kindness

In our mission to guide our community to wellness, Chaffey strives to recognize the kindness and generosity around us. Random Acts of Kindness Day gives us a full day to celebrate the kindness in our community and pay it forward.

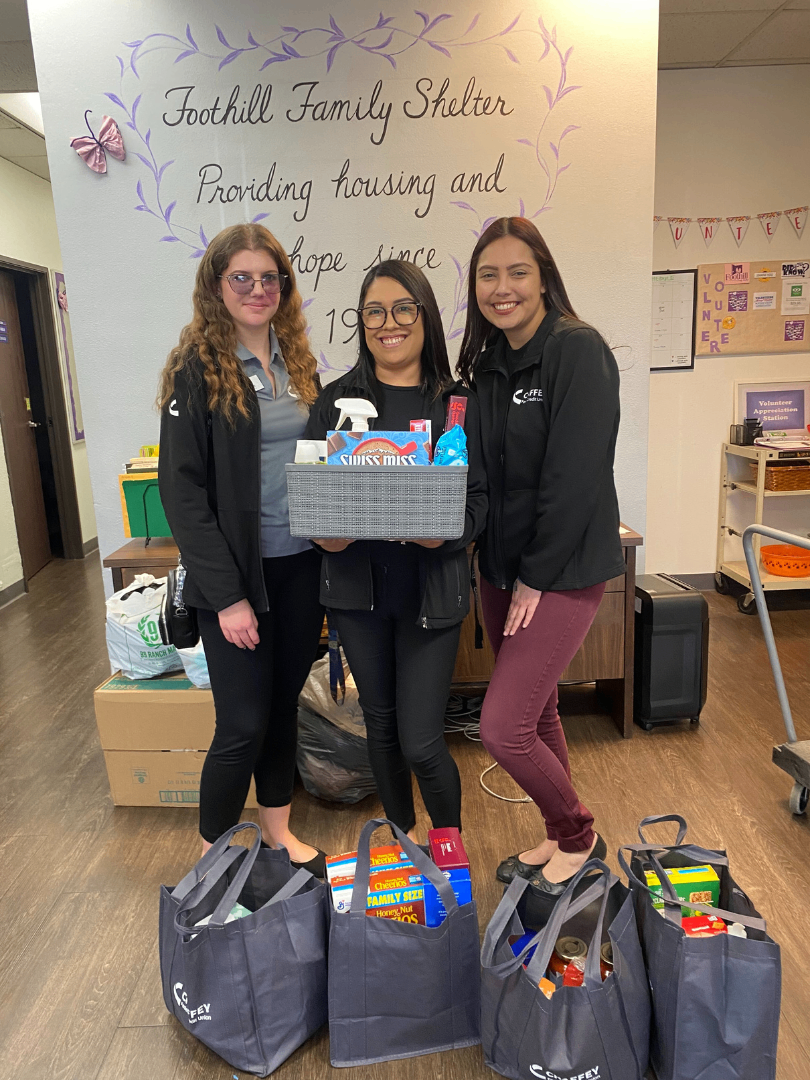

In honor of Random Acts of Kindness Day, we sought out to recognize the good in some of our neighbors. Chaffey staff went on a community tour, thanking and giving back to members of our community. We are excited to have brought food and personal care items to Foothill Family Shelter, pet and cleaning supplies to Friends of the Upland Animal Shelter, and educational tools to the kids supported by There is Hope Foster Family Agency.

Last Minute Taxes Resources

The tax season deadline is quickly approaching – April 15, 2024! Worry not, there’s still time to finish up if you haven’t completed your return.

Our guide to Conquering Tax Season is here to equip you with resources, safety tips, and reminders from the Consumer Financial Protection Bureau, the Taxpayer Advocate Service and more.

Still need to file? We’ve partnered with FileYourTaxes.com to bring you a fast, safe, and secure do-it-yourself tax software. Complete your return on your schedule from the comfort of your home.

Surprised by an unexpected tax bill? Completing your return can be stressful enough, without the shock of an additional bill. If you find yourself owing this season and need some extra help, the Chaffey FCU lending team is here to offer competitive rates on our Tax Relief Loan. Apply today to avoid penalties from missing payments on your state or federal taxes.