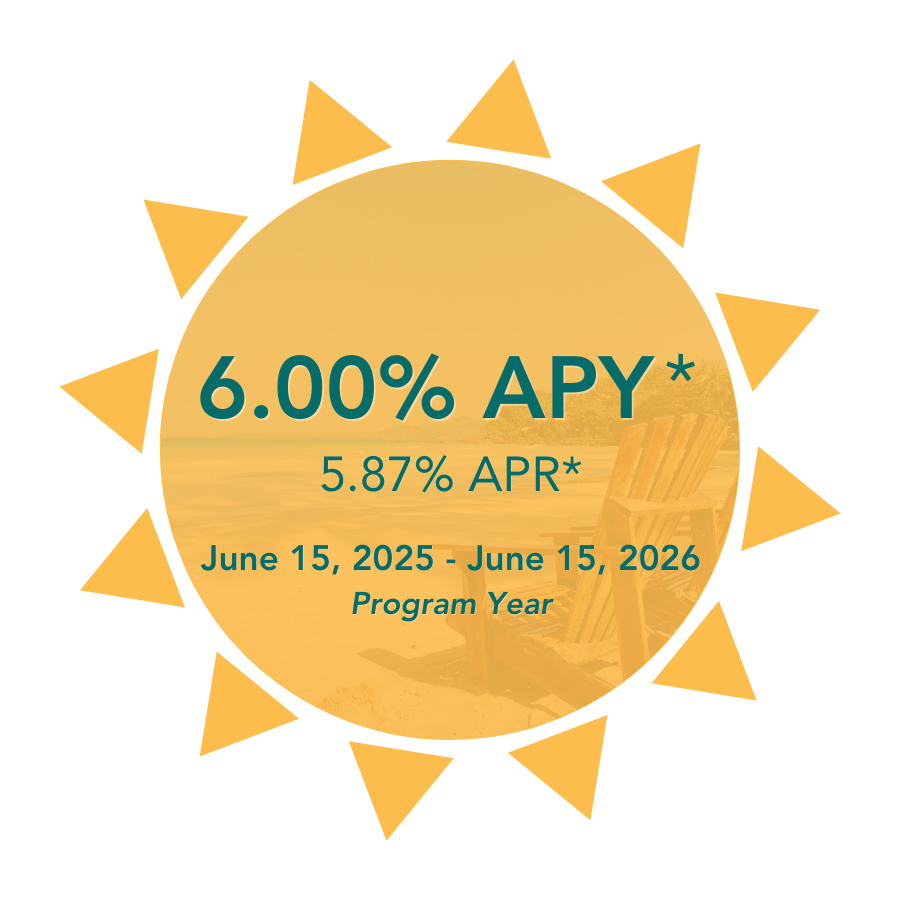

Originally designed to help educators during the summer months when they expect less income, the Chaffey Summer Savings Club is available to all Chaffey FCU members! Deposit $50 – $2,000 each month via direct deposit or payroll deduction and earn 6.00% APY* (5.87% APR)* for the entire program year. Dividends paid quarterly and at account maturity on June 15, 2026.

Summer Savings Club

Start building your sunshine.

Already a Member?

Simply call our Virtual Team (833-282-1033) or visit any Chaffey branch to open your Summer Savings Club account!

Not a Chaffey FCU Member?

Make an appointment to become a Member before opening a Summer Savings Club.

Get to know your Summer Savings Club!

*APY: Annual Percentage Yield, APR: Annual Percentage Rate. Rate advertised is for the 2025-2026 program year. In the event the account is closed or funds are withdrawn before maturity, dividends that have not been credited are forfeited. APY assumes dividends remain in account until maturity; early withdrawals reduce earnings. Dividends begin to accrue once funds are deposited into account. Dividends paid at the end of each calendar quarter and at account maturity on June 15, 2026. Balance computation method is as described in our Truth in Savings Agreement. Monthly direct deposit or payroll deduction of $50 – $2,000 must be set up for account; money transfer apps (i.e.: Zelle, Venmo) do not count as direct deposit. After 60 days of no deposits, Summer Savings Club account will be closed, and funds will be transferred to your regular savings account. Account will not be closed if there are no deposits during the summer months, but will be closed if deposits do not start by October 1, 2025. Earnings transferred to chosen savings account at account maturity. Account automatically renews at maturity with the updated rate for the new program year. Limit 1 Summer Savings Club account per Member. Federally insured by the NCUA.