Chaffey FCU Summer 2025 Newsletter

Summer is upon us, Chaffey Members!

The last three months have been busy for the team here at Chaffey FCU. In April, we held our Annual Meeting, your opportunity as a member-owner to vote for our Board of Directors and receive updates on the credit union’s position. During the month of May, our West Covina branch underwent a refresh which brightened the space and helped to open the lobby area a bit. Finally, in June, we completed an 18-month project for a technology conversion AND received approval from the NCUA to convert to a community charter credit union!

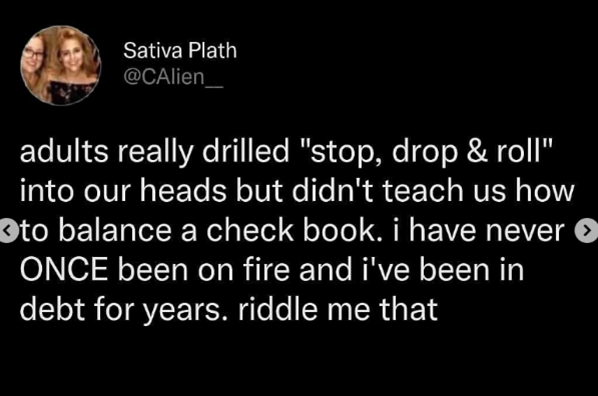

You may be asking yourself, “What is a community charter credit union, and why does it matter?” As opposed to our previous “multiple common bond” charter, which was primarily centered on educational centers, the community charter allows Chaffey FCU to provide services to anyone who lives, works, worships, or attends school within our charter boundaries. The new charter extends from eastern Los Angeles County into a significant portion of southwestern San Bernardino County. Chaffey FCU’s management and Board of Directors applied for the new charter because we recognize there is a need for financial education and resources for a majority of Southern California residents, and we wanted to make it easier for those who need our services to be able to access them. I saw this on Instagram recently and I feel like it summed things up pretty well:

For our members who work in education, there is no change to our product offerings, including those products that focus on educators such as our classroom supply loan.

As I write this newsletter article, I am coming off birthday party weekend for my daughter; for both of my kids, this year was the year of non-traditional birthday desserts: My older daughter had a cinnamon roll cake, and the younger one requested a chocolate-coconut pie. I don’t tend to eat much in the way of sweets, but I can see myself making these again!

From all of us at Chaffey FCU, enjoy your summer, and thank you for your membership.

PS – as an update on my lemon tree from the Spring newsletter, I have three lemons trying to grow, and I am trying to be patient!

Diane Kotlewski

Chief Executive Officer

Illuminating our Community with the Power of Financial Wellness.

Chaffey FCU is proud to announce that we are now a Community Charter Credit Union!

In our mission to light the way for our community to reach their financial goals, Chaffey FCU is now a Community Charter Credit Union. We are proud to offer our services to everyone who lives, works or regularly conducts business in, attends school, or worships in select parts of our southwestern San Bernardino and eastern Los Angeles County communities.*

Chaffey FCU was established by the Chaffey Unified School district in 1964 - and our dedication to education during this change remains unwavering. Chaffey FCU will continue to work directly with schools in our community to provide hands-on student financial education, specialized products for school staff, and scholarships. Now, we are able to share the light of financial wellness with more individuals and families in our community. Our free and low-cost financial services, education resources, W.I.S.E. Financial Coaching, and more are available to all of the schools, businesses, and families in our Community Charter Membership Field.

The Schools and Select Employer Groups (SEGs) previously included in field of Membership are not effected by this change. Now, employees and families of those organizations can easily refer friends and family to Chaffey FCU Membership!

*Complete Field of Membership details at chaffey.com/membership

Introducing Auto Alliance

An exciting new car shopping experience for Chaffey FCU Members.

As opposed to a traditional dealership, which tends to push the cars they have in stock, AutoAlliance helps you find the car that fits your lifestyle. From family vehicles to rare sports cars, AutoAlliance’s bespoke shopping experience and decades of expertise will put you at ease — and behind the wheel!

W.I.S.E. Workshops Introduced at Ontario City Library

In May and June, our Certified W.I.S.E. Financial Coaches illuminated the Ontario City Library with financial education. We welcomed young adults to enhance their financial wellness, with tools and education covering a variety of topics: building a budget for your lifestyle, methods to reduce debt, and how compound interest can build funds in your savings account (or make your loan more expensive!).

Keep an eye out for future public W.I.S.E. workshops from the City of Ontario Magazine of Ontario City Library Events Webpage.

Back to School Resources

Late nights, beach days, and vacations - there’s nothing quite like the freedom of Summer Break.

Make the most of summer while it lasts, the first day of the new school year will be here before you know it! As you get ready for your family to jump into a new school year, Chaffey FCU is prepared to help. With exclusive services to assist all school and district staff, and opportunities to help families save on school expenses, Chaffey FCU is your stop for back-to-school finances.

Skip-a-Pay: Qualified Members can skip a payment on their Chaffey FCU Personal Loan, Auto Loan, or Credit Card to keep some extra money in your wallet for back-to-school shopping!* You can skip your loan payment online here.

Back-to-School Personal Loan: If you need some additional help this school year, avoid high-interest rate debt and choose a Chaffey FCU Personal Loan with rates as low as 9.49% APR**. From laptops, school clothing, or moving costs - a Personal Loan offers the flexibility to cover your school season essentials.

For School Employees: When school employees have to turn to their own funds to support students, a 0% APR*** School Supplies Loan can provide extra support. The Chaffey FCU School Supplies Loan is available to any staff employed by a school or district. Apply today and borrow up to $1,000.

*Skip-a-pay Addendum amends your Loan Disclosure Statement and Agreement regarding your loan payment; Complete details at chaffey.com/skip-a-payment. Must pay a $20 fee on each loan skipped. Cannot skip consecutive months. Member must be in good standing with Chaffey FCU. Each loan is allowed a maximum of six (6) skips for the life of the loan.

**APR = Annual Percentage Rate. Rate accurate as of 7/1/25, estimated payment is $25.13 for every $1,000 borrowed at 9.49% for 48 months. The rate and APR are subject to change without notice. Rates shown include 0.50% discount which is the maximum discount offered through our members Rewards Program. Your rate and term will be based on your credit history.

***APR: Annual Percentage Rate. Advertised rate quote as of 6/24/2025, estimated payment is $100/month per $1,000 borrowed. Loan subject to approval and income verification. No credit check required. Applicants must be individuals employed by a school/school district for approval, loan not available for use by organizations or businesses. Maximum loan amount is $1,000; minimum monthly payment is $50. Maximum loan term is 10 months, must be paid in full by end of school year (June 30, 2026). Members can only have one (1) school supply loan at a time. Federally insured by the NCUA.

Make waves with a Summer Savings Club Account

Your financial success is our passion. That's why the Chaffey FCU Summer Savings Club Account is available to all Members.* Enjoy effortless, high-yield savings with a Summer Savings Club Account.

All Members: The Chaffey FCU Summer Savings Club is available to all Members who meet the direct deposit/payroll deduction requirements.

High Dividends: Watch your savings grow with high dividends, paid out quarterly and at account maturity—just in time for your sunny summer adventures!

Effortless Savings: Set aside $50 to $2,000 each month via direct deposit or payroll deduction. Plus, you can make a one-time extra deposit of up to $2,000 anytime during the program year.

Fixed Rate: Earn 6.00% APY* (5.87% APR*) for the entire term!

Flexible Withdrawals: Enjoy the freedom to withdraw your funds anytime without penalties, as long as your account is in good standing.

*APY: Annual Percentage Yield, APR: Annual Percentage Rate. Rate advertised is for the 2025-2026 program year. In the event the account is closed or funds are withdrawn before maturity, dividends that have not been credited are forfeited. APY assumes dividends remain in account until maturity; early withdrawals reduce earnings. Dividends begin to accrue once funds are deposited into account. Dividends paid at the end of each calendar quarter and at account maturity on June 15, 2026. Balance computation method is as described in our Truth in Savings Agreement. Monthly direct deposit or payroll deduction of $50 - $2,000 must be set up for account; money transfer apps (i.e.: Zelle, Venmo) do not count as direct deposit. After 60 days of no deposits, Summer Savings Club account will be closed, and funds will be transferred to your regular savings account. Account will not be closed if there are no deposits during the summer months, but will be closed if deposits do not start by October 1, 2025. Earnings transferred to chosen savings account at account maturity. Account automatically renews at maturity with the updated rate for the new program year. Limit 1 Summer Savings Club account per Member. Federally insured by the NCUA.

That’s a Wrap

Ending the 2024-25 School Year with Financial Education

The end of the academic year is always our busiest events season - jampacked with hands-on education before the start of summer break. Providing local students with meaningful financial education is at the center of our mission to guide our community towards healthy lives.

In the months leading up to the end of the school year, the Chaffey FCU team is proud to have worked with over 1,400 students in our community! From extensive 5-week courses, Bite of Reality budgeting simulations, and introductions to using financial services, we aim to ensure our students leave workshops with the tools to build lives centered around financial wellness.

Etiwanda High School - 5-Week Financial Courses

Etiwanda High School - Bite of Reality

Montclair High School - Bite of Reality

Los Osos - 5-Week Financial Courses

Colony High School - Bite of Reality

Arroyo Valley High School - Workshop at our Rancho Cucamonga Branch

Hope Through Housing - Youth Financial Education with My First Nest Egg

Bonita & Chaparral High School - Bite of Reality

East Valley SELPA - Introduction to Using Financial Services Workshop

July 2, 2025

Chaffey FCU Branch Locations

Rancho Cucamonga

11563 Foothill Blvd #101

Rancho Cucamonga, CA 91730

Upland

1024 W. Foothill Blvd.

Upland, CA 91786

West Covina

2333 S. Azusa Ave.

West Covina, CA 91792