Hello, Chaffey Members! Welcome to Fall!

This summer, my husband and I enjoyed a rare kids-free vacation, and I somehow convinced him to go zip lining through a mosquito-filled tropical forest! It is fair to say that between the two of us, I am the one that is more likely to ride roller coasters. So, while zip lining was new for both of us, I was definitely more excited at the prospect than my husband was. At one point I asked him if he was questioning his life choices…his response: “perhaps,” along with a look that said “never again.” After two hours of trying courses with various obstacles and difficulty, he told me that even though he never had zip lining on his bucket list, he was glad that he had gotten out of his comfort zone, and he had enjoyed the outing (mosquito bites aside).

This experience got me thinking about how many of us can be hesitant to try new things. It is in human nature to stay with the familiar, but this does have the potential to limit us in ways we may not think about. Money management is one area where many individuals want to stick with what they know. While life may not feel 100% comfortable in your current financial situation, the idea of trying new things can be very scary. However, much like my husband and the zip line courses, there can also be a sense of exhilaration achieved by attempting new tactics for managing your funds or your debt. If you feel like you are in a “rut” when it comes to your finances, I encourage you to take a look at Chaffey FCU’s W.I.S.E. financial coaching program. Our certified financial coaches can work with you to push the boundaries of your comfort zone and new paths to achieving your goals. Whether you are looking to reduce debt, build savings, or simply feel more confident about your financial future, our certified coaches are here to help.

W.I.S.E. is just one of Chaffey’s efforts that have earned us the 2025 Social Impact Award from California’s Credit Unions! We are very grateful to have our hard work in the community recognized by the credit union movement. This recognition reflects our commitment to serving you, our members —not just with financial products, but with real impact in our community.

For those who have been reading the FOCUS newsletter the past few quarters, you know that I have been tracking my lemon tree through all of 2025 to see if I can finally have lemons that I can enjoy from my backyard. I should soon have at least one lemon ready to pick (who knew it would take this long??), and at last count I had a total of eight lemons growing! I just might have the opportunity to make a lemon pie one day, but if the one lemon is ready long before the rest, perhaps I’ll use it to cook this dinner one night. It seems like a good comfort food dish for the fall.

Much like financial goals, growing lemons takes time, care, and a little faith. I’ll admit—the patience this lemon tree is testing might just be my own way of stepping out of my comfort zone! I’m hopeful that this harvest—and your financial journey—will be fruitful.

From all of us at Chaffey FCU, we wish you all the best for the fall season. As always, thank you for your membership!

Diane Kotlewski

Chief Executive Officer

Award Winning Community Impact

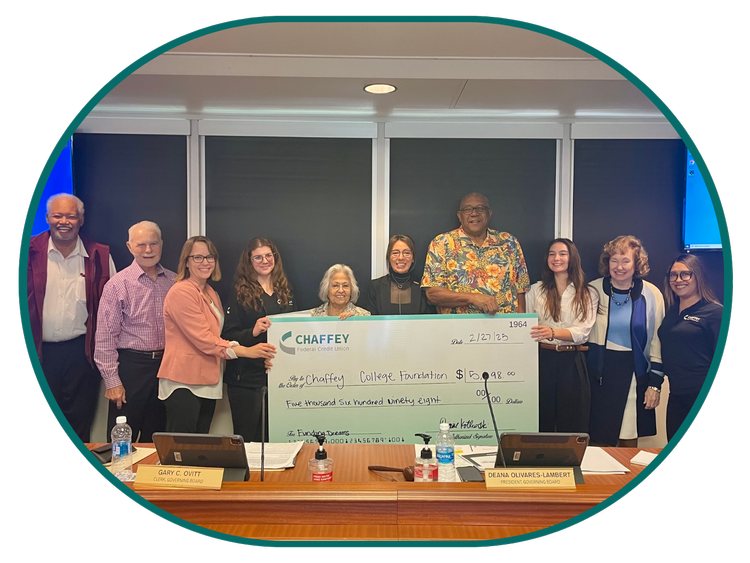

Social Impact Award

Each year, Credit Unions across California and Nevada are recognized for their achievements by the California and Nevada Credit Union League. This year Chaffey FCU is honored to be one of three credit unions receiving the Social Impact Award! This award honors credit unions that “demonstrate an unyielding dedication to building stronger communities and improving members’ lives.”

Each year, we strive to create a larger impact in our community by encouraging financial health and support throughout our community.

Over the last year, Chaffey FCU has:

Reached over 3,100 students with financial education classes, Bite of Reality simulations, and other workshops.

Donated over $34,000 to dozens of schools, organizations, and shelters.

Proudly launched W.I.S.E. Financial Coaching to help our Members conquer financial obstacles.

Became a Community Charter Credit Union, allowing us to offer financial services and education to more people in our community.

Six Weeks of Financial Education

Strengthening Students’ Future

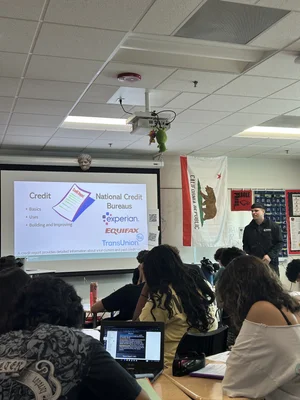

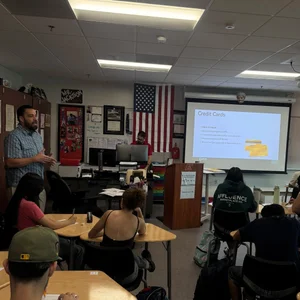

Each school year, Chaffey FCU works with various classes and school campuses to bring financial education courses to local students. Our most recent project: a six-week course at Etiwanda High School, hosting a variety of presentations designed to build a strong foundation of financial knowledge for seniors before graduation.

- Introduction to Financial Services

- Budgeting & Credit Scores

- Lending Basics

- Basics to Financial Wellness

- Taxes Defined

- Housing Expenses

And at the end of the course, we put the students’ learning to the test with a Bite of Reality simulation! A hands-on budgeting workshop, where students receive a job description, income, and credit to manage their monthly expenses: housing, transportation, groceries, savings, and everything else needed to successfully get through the month.

International Credit Union Day

On October 16, 2025, Chaffey FCU Will Join Credit Unions Across the World in Celebrating the 77th Annual International Credit Union Day!

This year, International Credit Union Day is celebrated with the theme of “Cooperation for a Prosperous World”. Did you know that credit unions work together to serve their members, not make a profit? Even credit unions that may appear to compete with each other often work together in mutual support of their communities, and Chaffey FCU is no exception

All credit unions work together to share a common goal: offering access to affordable financial services to their members and providing even the most financially disadvantaged the tools and the opportunities to be financially self-sufficient. Making life choices and dreams a reality is the credit union difference that makes a real impact in our world. This year, we’ll be honoring Chaffey FCU Members and other credit unions around the world with special treats, presentations, and savings opportunities.

What’s Really Spooky?

Halloween may be our favorite spooky time of year, but scammers are hiding in plain sight all year round.

Three tips for teaching kids to spot a scam, from My First Nest Egg.

- Don’t Take the Candy! If something seems too good to be true—like a free Roblox code or prize—it probably is. Teach kids to pause before they tap.

- Ghostbusters Rule: Tell an Adult. If a message, pop-up, or link feels weird, the safest move is to call in backup. Encourage kids to come to you right away.

- Spot the Costume. Scammers often pretend to be someone you trust. Look closely—does the email look off? Is the message urgent and strange? Help kids learn to recognize red flags.

Do you know which scams to look out for?

When discussing scam prevention with your families, it can be helpful to know what to look out for. Read the full blog for insight on scams that typically target kids.

Earn More with Every Purchase This Holiday Season

Visa Rewards

This holiday season, make your purchases even more rewarding. With a Chaffey FCU Visa Credit Card, you can earn a variety of rewards while you shop for holiday gifts, make festive meals, and plan family travel. This season, gift yourself with cash back, travel, or merchandise when you select your Chaffey FCU Visa Credit Card for purchases.

- All Credit Card holders can participate. The Chaffey FCU Visa Rewards Program is available on all Chaffey FCU Visa Credit Cards.

- No Annual Fee to participate in Visa Rewards. Earn reward points at no extra expense!

- Rewards on every swipe. Earn 1 point for every dollar spent.*

- Convenient Rewards Access. With the CURewards portal, you can view, manage, and spend your Visa Rewards points anytime. Access your rewards account directly through the Chaffey FCU Online Banking portal or Mobile App for maximum convenience.

- Effortless rewards. You pay your bills anyways – make the process more exciting and get rewarded with travel, electronics, cash back, tickets, and more!

*1 point earned for every $1 spent. Cash advances and balance transfers are not eligible. Must have a Chaffey FCU Visa Credit Card to participate in Visa Rewards. Account must be in good standing to earn Visa Rewards. Business accounts are not eligible. Points are good for 3 years. Speak with a representative or visit chaffey.com/visa-rewards.

Coast through the rest of the year with a vehicle you love.

Enjoy No Payments until 2026!

Going back to school, preparing for the holidays, or starting a new job. We understand that our Members have a lot going on. To make the rest of the year easier, we’re offering no payments until 2026* on qualifying Chaffey FCU Auto Loans! Available on new and used vehicles for a limited time.

Chaffey FCU designs our Auto Loans with your financial wellness in mind.

- Competitive rates from 4.99% APR** to optimize your savings

- Affordable Guaranteed Auto Protection (GAP) & Mechanical Protection plans

- Rate discounts for automatic loan payments

Combine the money-saving benefit of a Chaffey FCU Auto Loan with the convenience of No Payments for Up To 90 Days* and enjoy the upcoming holiday season stress-free.

*Offer subject to credit approval and other underwriting criteria. Payment deferral terms vary based on creditworthiness. Not all applicants will qualify for the complete deferment period. First payment due date dependent on auto loan funding date. Available on auto loans applications submitted through December 31, 2025. Offer subject to change without notice.

**Annual Percentage Rate. Advertised rate quoted as of 10/1/25, estimated payment is $29.94/month for every $1,000 borrowed at 4.99% APR for 36 months. Other rates and terms available, maximum rate is 18%. All rates and terms available at chaffey.com/rates-1. Proof of income and auto insurance is required before approval. Loan approval is subject to credit and income evaluation. Program rates, terms, conditions and services are subject to change without notice. Restrictions may apply. Rate shown includes a 0.50% discount for automatic payments. No other discounts apply. Federally insured by the NCUA.